select the best description of the mortgage note framework

It includes terms such as. A mortgage note contains all the terms and conditions of the mortgage loan that will govern the repayment relationship between the borrower and lender.

:max_bytes(150000):strip_icc()/Comparative-Market-Analysis.Folger-656a8b7e5889401c94eacd9b0eccf8d2.jpg)

Comparative Market Analysis Cma Definition

While the mortgage itself pledges the title to real property as security for a loan the mortgage note states the amount of debt and the rate.

. When this happens the lending company may accelerate the debt which usually means the lender adjusts the due. If you live in one of these states youll receive that legal. You have to meet all the conditions before the loan can close.

A mortgage note is the agreement between a lender and the buyer of a home or property. A mortgage note in pdf serves to authorize the lending company of claiming the property being used as a collateral in the instance that the borrower fails to meet the set conditions or fails to repay the loan during the set time frame. A mortgage hypothecreate property as collateral for the loan.

While the mortgage itself pledges the title to real property as security for a loan the mortgage note states the amount of debt and the rate of. Closing also known as settlement is the last step in the mortgage process. The ITV on this investment would be 50.

A mortgage note is a legal document that sets out all the terms of the mortgage between a borrower and their lending institution. This legal document describes the amount of the loan and terms of repayment including duration and interest rate. Any terms not contained in the note will not be considered in case of a dispute or mortgage default.

Experts are tested by Chegg as specialists in their subject area. Who are the experts. In a private mortgage the borrower makes payments to a private person or entity directly.

It commits you to paying your loan It lists all costs associated with your loan. While the mortgage deed or contract itself hypothecates or imposes a lien on the title to real property as security for a loan the mortgage. 10 regarding the use of a mortgage which of the following statements is correct.

Terms of your loan eg 30-year fixed or. Mortgage notes are a written promise to repay a specified sum of money plus interest at a specified rate and length of time to fulfill the promise. A mortgage is evidence of a borrowers debt to A lender.

It usually includes principal interest taxes and insurance. Whether monthly or bimonthly payments are required. Mortgage note A legal document stating your obligation to repay the mortgage loan at a stated interest rate over a set time period.

Select the best description of the mortgage note. The terms include interest rate payment amount frequency and the date for when payments are due in full. Mortgage notes are a type of promissory note that details repayment of a loan used to purchase real estate.

Ask an expert Ask an expert done loading. Divide by the propertys fair market value of 200000. Your mortgage note lays out all the specifics of your loan including the following.

A legal document by which the owner ie the buyer transfers to the lender an interest in real estate to secure the repayment of a debt evidenced by a mortgage note. The total amount of the home loan. It contains the promise by the buyer to repay the amount of money loaned plus interest over a specified period of time to the mortgages lender.

See the answer See the answer done loading. A mortgage note is a legal instrument that outlines the terms and conditions for the repayment of a loan or promise to pay thus the term promissory note. ANSWER false 2-Select the list that has the steps of the closing process in the right order.

The down payment amount. A mortgage note is a promissory note promising to repay a specified sum of money plus interest at a specified rate and length of time to fulfill the promise. A mortgage note is a promissory note promising to repay a specified sum of money plus interest at a specified rate and length of time to fulfill the promise.

I bold my answers but 2 of them are wrong please tell me which answers are wrong and whats the right answers for them 1-The closing is conducted by the sellers agent. When the debt is repaid the mortgage is discharged and a satisfaction of mortgage is recorded with the register or recorder of deeds in the county where the mortgage was recorded. Next thing you know the keys are in your hand.

Mortgage notes will contain the loan terms such as. We review their content and use your feedback to keep the quality high. The collateral for the Note is a Mortgage.

A higher interest rate on the promissory note is more attractive to an investor provided the buyer can afford the payments. The language used should be formal and the note should include all relevant details. Bank Merger Framework Discussed Glimmer Of Hope For Homebuyers.

Document states that promissory note or bond has been paid in full and the mortgage can be discharged from public records Partial release Occurs when the borrower wants the lender to release a portion of the mortgaged property from the mortgage after part of the loan has been repaid. A mortgage note is an essential legal document which includes the amount of mortgage involved and a promise to repay it at specific time period at given conditions. The Mortgage Note is a news site dedicated to reporting on the latest news insight and trends around the mortgage and housing industries.

Or in other words a 50 cushion would exist in the event the note you purchase defaults. Loan amount date of first payment date of maturity interest rate payback period and other relevant items. Description Mortgage Note Sample.

Morning Roundup 592022 Consumer Sentiment Down Refi Closing Costs. Morning Roundup 562022. In the United States a mortgage note is a promissory note secured by a specified mortgage loan.

You sign all the final documents and the lender funds the loan and pays the seller plus anyone you owe fees to. It is among the most important documents in a mortgage hence should be treated as such. Mortgage payment The payment made to the loan servicer for the mortgage loan.

Add the senior lien of 60000 to your anticipated note purchase price of 40000 for a total of 100000. An owner may not occupy mortgage property. A mortgage must reference an earnest money agreement when serving as collateral for a loan.

Mortgage loan A secured loan used to buy a home or other property. If there is a balloon payment a Funder will want to know the buyer can reasonably. Some states use deeds of trust instead of mortgages.

What Is A Mortgage Note Rocket Mortgage

Understanding Loan Management Systems Visartech Blog

Pin On Flevy Business Best Practices

Scenario Planning Navigating Through Today S Uncertain World Change Management Work Skills Business Analysis

Estate Property Sales Rental Wordpress Theme Rtl Ad Sales Amp Estate Property Real Estate Estates Property For Sale

Mortgage Brokering Sector Supervision Plan 2021 22 Financial Services Regulatory Authority Of Ontario

Understanding Loan Management Systems Visartech Blog

Ruby On Rails Web Development In 2021 Document Management System Web Development Ruby On Rails

Down Payment Assistance Kentucky 2021 Kentucky Housing Corporation Khc Mortgage Marketing Mortgage Banker Mortgage Tips

Strayer Cis 446 Case Study 1 Packaged Solutions For Erp Implementation Case Study Study Solutions

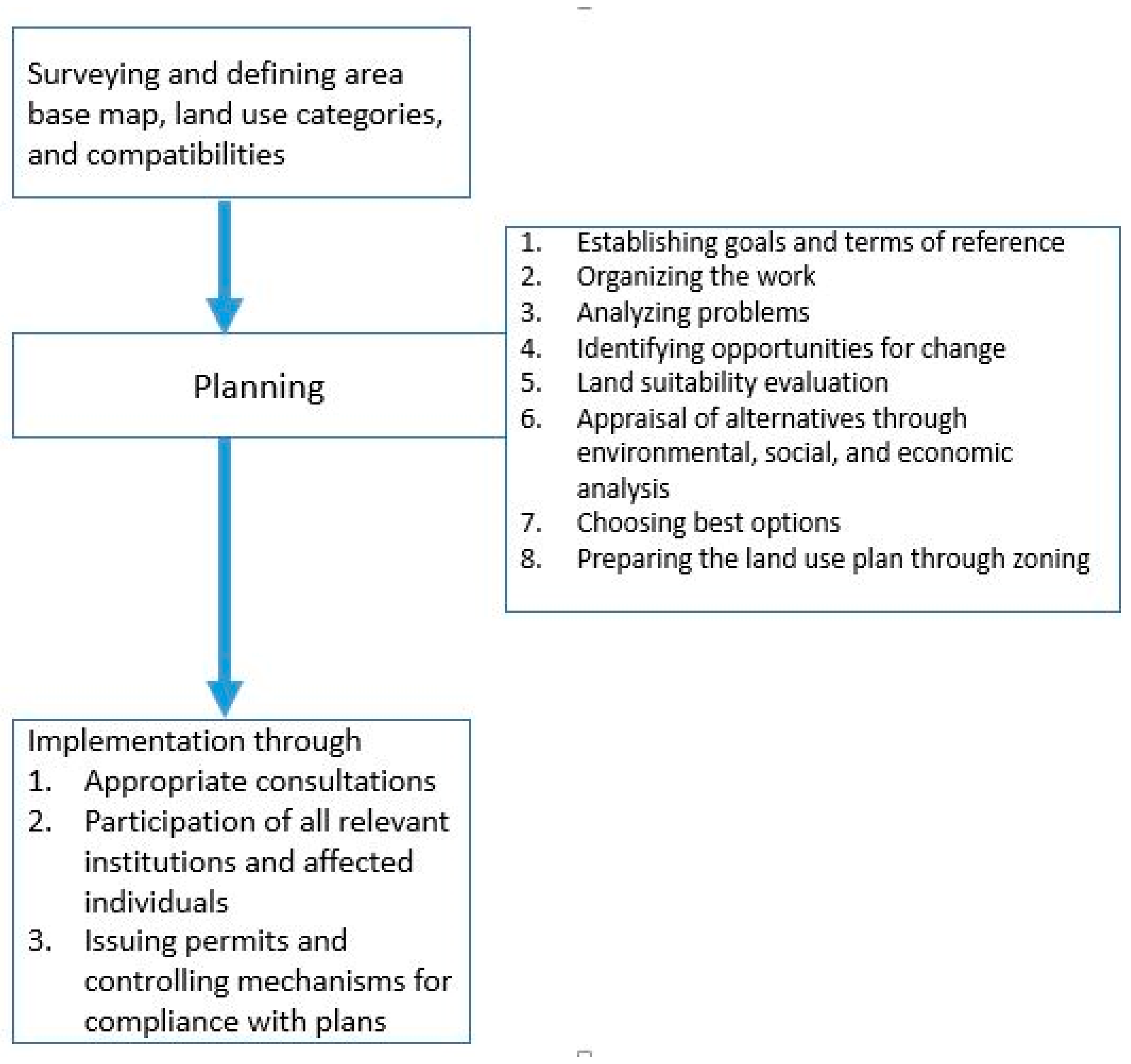

Land Free Full Text Transparency Of Land Administration And The Role Of Blockchain Technology A Four Dimensional Framework Analysis From The Ghanaian Land Perspective Html

Mortgage Brokering Sector Supervision Plan 2021 22 Financial Services Regulatory Authority Of Ontario

Pin On Simple Succession Plan Templates

Understand The 5 C S Of Credit Before Applying For A Loan Forbes Advisor

7 Tried And True Real Estate Marketing Tips To Get More Clients In 2020 Venngage

This particular is usually apparently essential and moreover outstanding truth along with for sure fair-minded and moreover admittedly useful My business is looking to find in advance designed for this specific useful stuffs…Mortgage note buyer

ReplyDelete